Asset class recap for November

Stock and bond prices ripped higher during November, as many investors have come to expect that the Fed is going to lower interest rates during 2024, which would justify higher stock and bond prices. For 2023 so far, all the asset classes we track in the table below have positive returns except Long Term Bonds, which is the most interest rate sensitive asset class.

When we compare the Year-to-Date 2023 column to the 2022 column, we can see that no Equity asset classes have totally recovered from their 2022 drawdown**, but most are close. On the other hand, Bond asset classes have had a tougher time digging out of their 2022 performance hole. This will take time as today’s higher interest rates provide investors with much higher monthly and quarter coupon payments than they were receiving two years ago.

** The Dark Side Of Compounding - Remember that negative returns impact portfolios more severely than positive returns. For example, the 29.1% loss for US Growth Stocks in 2022 will require a 41.1% positive return to fully recover. The difference between negative and positive returns can be hard to believe until you see an actual example.

Large Cap Growth stocks had the highest returns in November, as momentum for Artificial Intelligence related companies continued. Valuations for many of these companies have reached sky-high levels (not quite 1999 tech bubble levels, but in the neighborhood), which often portends the end of a momentum run and a change in leadership.

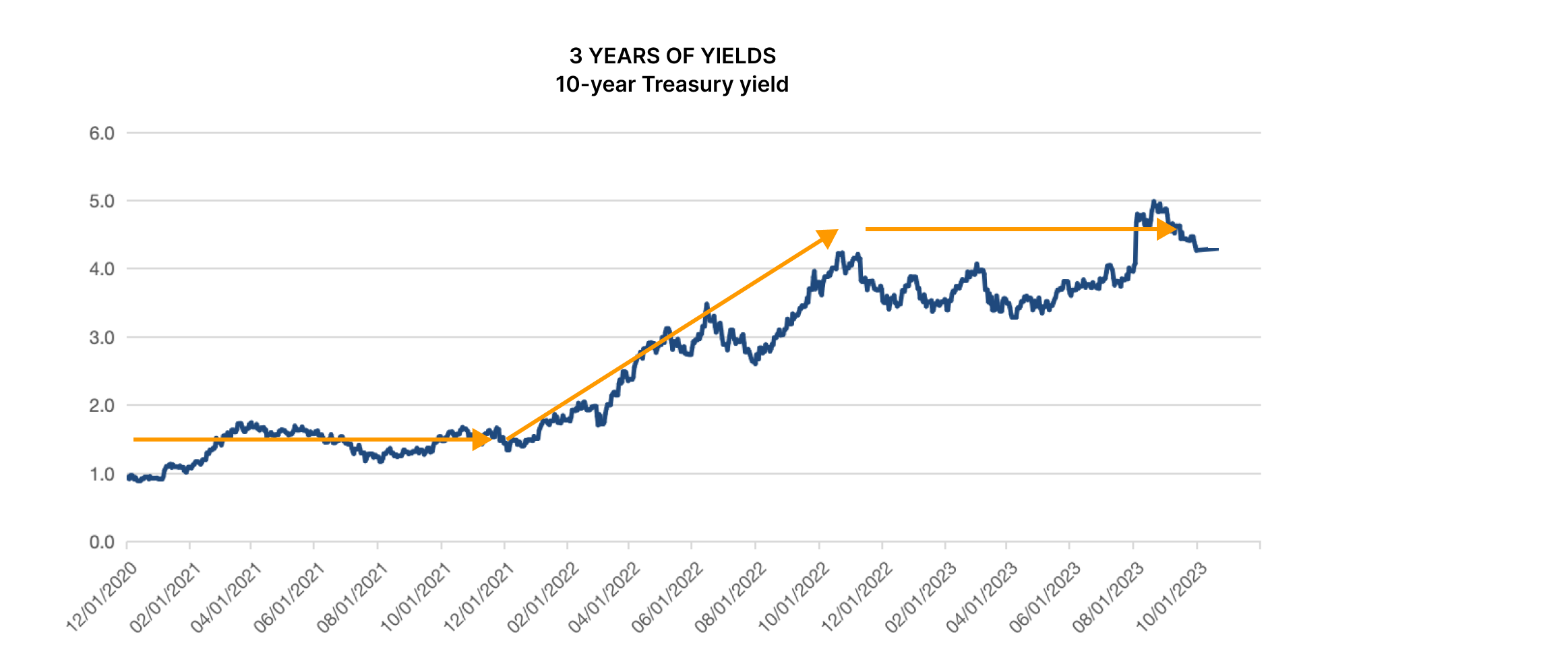

The table below shows quarterly returns for the last 3 years for US Stocks, Non-US Stocks, and Bonds. I shaded the negative returns in orange to clearly highlight the streaky periods of investment security price depreciation that we have seen during the last few years. I added a chart with 10 Year Treasury Yields right below it to show how the negative/orange return periods in the table coincide nearly perfectly with periods when interest rates jumped up. I expect that interest rates are nearly done rising and that the overall market environment for 2024 will be less risky than the last couple years because the specter of rising rates has largely abated. However, I won’t go as far as many of my peers and forecast rate cuts for 2024. I expect that the Fed will hold off on cutting rates until we encounter our next financial crisis. While there is no impending crisis on the immediate horizon, one is always eventually inevitable, but one or two years of 5% coupon payments on bonds would sure be nice for retired investors who typically own these bonds.

Tax Loss Harvesting – Opportunities Are Plentiful For Some Accounts

Periodic scheduled tax loss harvesting and tax management for transitions in taxable accounts have the potential to improve overall wealth for our clients and are a major piece of the value proposition advisors and Advyzon bring to their clients. Every year presents unique conditions for advisors when it comes to tax management for investment accounts. 2023 is no different. The Advyzon Investment Management trading team has been reviewing accounts for harvesting opportunities during the last few weeks and we are finding that the high volatility for market returns, coupled with the high degree of correlation of return among asset classes for the last few years have left us with unique situations that can be grouped roughly around the date the original investments were made into the market.

Long term accounts – 2019, 2020, and 2021 were such good years for market returns, that accounts that were invested before this period will typically have few unrealized losses to harvest, which is terrific for investors, but leaves tax loss harvesting strategies largely ineffective. When we look at market returns for the last 5 years, only a couple asset classes have slightly negative returns and unrealized losses that might be harvested, including; international bonds, international real estate, and long term government bonds. However, even in these well tenured accounts, there can still occasionally be particular tax lots that were purchased more recently that can be carrying unrealized losses that can be harvested.

Mid term accounts – The S&P 500 hit its all time high of 4,796 on 1/3/2022. If you have accounts that invested around that time, you are likely to find many investments that are sitting on unrealized losses today. Total returns for nearly every asset class (except very short term bonds and some energy related investments) are negative between 1/3/22 and 12/4/23. With ample opportunity to realize losses in these accounts, some advisors and investors will elect to harvest all losses and build up a carryforward for future tax seasons, while some investors will target offsetting current realized gains plus an extra $3,000 to write off during this year’s tax season (the maximum you can realize in any single year).

Short term accounts – Newer accounts that opened around the start of this year should be sitting on very healthy gains and won’t have any opportunity for loss harvesting. Per the YTD column in the first table of this writeup, 2023 has been a good year for market returns.

You do not need to have a Master of Business Taxation degree to incorporate shrewd tax loss harvesting moves in your client portfolios – Advyzon has included features throughout each app to help advisors with this task. It is simple to identify securities that currently have unrealized losses on Advyzon’s Holdings – Gain/Loss screen. Quantum users can quickly and easily act upon this information by running Tax Loss Harvest Rebalancing. The Model Portfolios app allows advisors to set up default Tax Loss Harvest replacements for each security in their portfolios to streamline the process. For advisors who currently use a lot of mutual funds and ETFs, moving equity allocations into Separately Managed Accounts found in Nucleus Model Marketplace can open up a lot more opportunity for future harvesting, as gains and losses are not aggregated up to a fund level. Advisors who want to engage a seasoned, efficient partner for this task can hire Advyzon Investment Management to do the work for them.

Important Disclosures

Opinions expressed are as of the current date; such opinions are subject to change without notice. Advyzon Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment or a recommendation for a particular product.

Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. This commentary contains certain forward-looking statements. We may use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

Investment management and financial advice offered by Advyzon Investment Management is intended for citizens or legal residents of the United States or its territories. Investing in securities involves risks, including but are not limited to; currency risk, political risk, geographic risk, concentration risk, custody risk, asset class risk, management risk, market risk, operational risk, passive investment risk, securities lending risk, tracking error risk, tax risk, valuation risk, and infectious illness risk. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. High yield debt (non-investment grade or junk bonds) can be more risky than higher rated debt, typically has a higher default rate than investment grade and treasury debt, and high yield funds can lose principal.

“SBBI” stands for “Stocks, Bonds. Bills, and Inflation”. “Stocks, Bonds, Bills, and Inflation”, “SBBI”, and “Ibbotson” (when used in conjunction with a series or publication name) are registered trademarks of Morningstar, Inc. ©2021 Morningstar.

“CRSP” stands for Center for Research in Security Prices. Part of the University of Chicago’s Booth School of Business, the CRSP is a nonprofit organization that is used by academic, commercial, and government agencies to access information such as price, dividends, and rates of returns on stocks.

The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Advyzon Investment Management cannot guarantee its accuracy, completeness or reliability.